The history behind the financial system (which controls all countries) and the global collateral accounts, upon which the banking system is based, is vast and complex and the modern system reaches back some 250 years; however, the origins of this system stretches back to Babylonian commerce and the Sumerian empire before it;

The following briefly outlines what the global collateral accounts are:

A BRIEF HISTORY OF THE GLOBAL COLLATERAL ACCOUNTS AND NEIL KEENAN’S EFFORTS TO FREE THEM

by Michael Henry Dunn; June 8, 2013

The history behind the Global Collateral Accounts is vast and complex, and reaches back some 250 years. For the purposes of this brief overview, we will focus on two key elements which are now headlining stories around the world: debt, and gold.

The Western banking oligarchy’s current global control can be traced back to the Rothschild family’s dominance of international banking in the early years of the 19th century. The long-term strategy of the elite banking and royal bloodline families was simple: gain control of the global gold supply in order to maintain power through the control of global currency and its underlying collateral. Gold and Debt – that is the essence of this story.

Where Did the Gold Come from and to Whom Does It Belong?

For two thousand years, the gold of the world flowed east toward China, along the Silk Road, from the Roman Empire, on through to the Byzantine and the Spanish, in exchange for the silks, spices, and treasures of the East. When the bankers of Europe decided to seek control of the world financial system, control of this gold became essential.

Who created the Global Collateral Accounts and why?

Operation Golden Lily is the well-documented story of the Japanese gold-collecting teams, which infiltrated key gold-holding nations well in advance of the military invasions of China and other nations, with the express intent of seizing the hundreds of thousands of metric tons of gold that had accumulated in Asia (primarily in China). The Nazi gold-collecting system is well-known, but the Japanese accumulated a far greater hoard, with the knowledge and cooperation of certain European banking interests.

Where is the gold and how did it get there?

The “official” total for the entire amount of gold said to be above ground since humanity first began mining the precious metal is approximately 160,000 metric tons. Evidence now indicates that a more accurate figure is well in excess of two million metric tons. During World War Two, the Japanese dug tunnels and bunkers throughout Southeast Asia to store the gold – primarily in Indonesia, Thailand, and The Phillipines. After the war, the gold was discovered by the Allies, and was incorporated into a system set up by the European central bankers before the war for this very purpose. The exact total of the wealth in the off-ledger accounts is not known, but is said to be in the thousands of trillions of dollars in gold, platinum, and gems, in addition to an undetermined amount in Federal Reserve notes and other currencies.

How did the nations come to agree that the Accounts were to be used for humanitarian programs?

At the Bretton Woods Conference in 1944, when the soon-to-be-victorious Allies met to create a new global financial system, the International Monetary Fund was created. In the late 1940’s, President Sukarno of Indonesia was appointed monetary controller of behalf of the depositors to monitor and implement the Global Accounts for redevelopment purposes.

How did the banking elite abuse the Accounts?

The central banking families had already put in place essential structures to seize and control this wealth: the Bank of International Settlements, the International Monetary Fund, the Council on Foreign Relations, and the United Nations, all of which were funded by elite banking figures, including the Rockefellers and Warburgs. The agreements to use the funds for development were neglected, and the banking elite proceeded to use them for their own ends, blocking the depositors from access. President Sukarno of Indonesia had been appointed “M1” or Monetary Controller of the Accounts (as much of the assets are stored in hidden bunkers in Indonesia), but he was removed from power after making a deal with John F. Kennedy to use the funds to back new U.S. Treasury dollars, in a direct move against the central bankers’ power. Kennedy’s assassination prevented this move from succeeding.

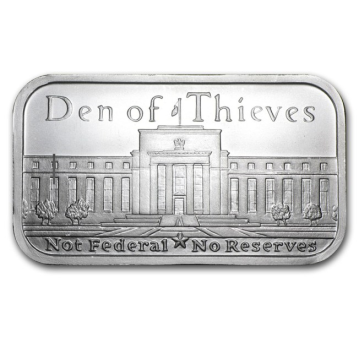

The central bankers put in place a system that allows the Federal Reserve to block anyone but banking elite insiders from using the Accounts, thus blocking the actual owners – the depositors – from utilizing the assets for humanitarian programs, as originally intended.

Read full article at: http://neilkeenan.com/sample-page/

TRAGEDY & HOPE

“The powers of financial capitalism had another far reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole.

This system was to be controlled in a feudalistic fashion by the central banks of the world acting in concert, by secret agreements, arrived at in frequent private meetings and conferences.

The apex of the system was the Bank for International Settlements in Basle, Switzerland, a private bank owned and controlled by the worlds’ central banks which were themselves private corporations.

The growth of financial capitalism made possible a centralization of world economic control and use of this power for the direct benefit of financiers and the indirect injury of all other economic groups.” [Professor Carol Quigley (Bill Clinton’s mentor) – Tragedy and Hope – A history of the world in our time]

Tragedy & Hope – Prof C Quigley

One World Bank; One World Government; Cashless Society

Financially, there are only four countries. One bank, the Bank of International Settlement, run by the Rothschild’s in Geneva, Switzerland. The same Rothschild’s who are the Bankers to the Vatican. The countries that do not clear through the BIS, are Libya, Afghanistan, Iraq, Iran North Korea and Syria. Is it any wonder Russia and the US are targeting these countries?

The City of London has been granted various special privileges since the Norman Conquest, such as the right to run its own affairs, partly due to the power of its financial capital. These are also mentioned by the Statute of William and Mary in 1690.

City State of London is the world’s financial power centre and wealthiest square mile on earth — contains Rothschild controlled Bank of England, Lloyd’s of London, London Stock Exchange, ALL British banks, branch offices of 385 foreign banks and 70 U.S. banks.

It has its own courts, laws, flag and police force — not part of greater London, or England, or the British Commonwealth and PAYS ZERO TAXES!

City State of London houses Fleet Street’s newspaper and publishing monopolies (BBC/Reuters), also HQ for World Wide English Freemasonry and for worldwide money cartel known as The Crown…

For centuries the Bank of England has been center of the worlds fraudulent money system, with its ‘debt based’ (fiat currency).

The Rothschild banking cartel has maintained tight-fisted control of the global money system through:

- The Bank for Intl. Settlements (BIS),

- Intl. Monetary Fund (IMF) and

- World Bank — the central banks of each nation (Federal Reserve in their American colony), and satellite banks in the Caribbean.

They determine w/the stroke of pen the value of ALL currency on earth it is their control of the money supply which allows them to control world affairs (click here for Federal Reserve owners) — from financing both sides of every conflict, through interlocking directorates in weapon manufacturing co.s’, executing global depopulation schemes/ crusades/ genocide, control of food supply, medicine and ALL basic human necessities.

Read full post at:

https://tabublog.com/2017/04/30/one-world-bank-one-world-government-cashless-society/

BANKING CARTEL

The Dulles Brothers, Harry Dexter White, Alger Hiss, and the Fate of the Private Pre-War International Banking System

The era of private banking influence, as symbolized by the BIS, was also restored, but within a new framework which also incorporated the public institutions of the International Monetary Fund and the World Bank.

For a quarter century, until it ended under Nixon in 1971, the Bretton Woods system largely worked, and the BIS functioned as part of its infrastructure. America prospered; and there were signs of a healthy reduction in income disparity, not just in America, but also in the Third World. Discussing the researches of the economist Thomas Piketty into the reduced income inequality of that era, Richard Brinkman has written, “The immediate period after WWII, from 1950 to 1973, has come to be called the Golden Age…. a close approximation to the best that in practice can be obtained from a capitalist economy.”64

Thanks to the Vietnam War and other factors, America went off the gold standard in 1971. Since then the dollar has been sustained by a system of high petroleum prices, highly profitable to the oil cartel, for which increasingly impoverished third world countries are forced to pay in dollars.

That is another story, too complex to be told here. But a major factor in the eventual collapse of the Bretton Woods system was the success of the Dulles brothers in freeing Wall Street and the oil majors from the restraints of law.

Peter Dale Scott, a former Canadian diplomat and English Professor at the University of California, Berkeley, is the author of Drugs Oil and War, The Road to 9/11, and The War Conspiracy: JFK, 9/11, and the Deep Politics of War. His most recent prose book is American War Machine: Deep Politics, the CIA Global Drug Connection and the Road to Afghanistan. His website, which contains a wealth of his writings, is here.

Recommended citation: Peter Dale Scott, “The Dulles Brothers, Harry Dexter White, Alger Hiss, and the Fate of the Private Pre-War International Banking System” The Asia-Pacific Journal, Vol. 12, Issue 16, No. 3, April 21, 2014.

Read further at: https://rielpolitik.com/2016/04/20/the-dulles-brothers-harry-dexter-white-alger-hiss-and-the-fate-of-the-private-pre-war-international-banking-system/

‘Let the American people go into their debt-funding schemes and banking systems, and from that hour their boasted independence will be a mere phantom.” – William Pitt Chancellor of the Exchequer, at the inauguration of the first National Bank in the United States under Alexander Hamilton.

The U.S. is quickly becoming known as the new Switzerland of international banking, due to its refusal to sign onto the new global disclosure standards, issued by the Organization for Economic Co-operation and Development (OECD), a government-funded international policy group.

The process of moving massive amounts of international capital from typical tax havens, into the U.S., is being driven by a familiar name in the world of international finance – Rothschild & Co.

Rothschild, a centuries-old European financial institution, manages the wealth of many of the world’s most wealthy families and has been instrumental in helping move the global elite’s wealth from traditional tax havens like the Bahamas, Switzerland and the British Virgin Islands to the U.S.

Driving the phenomena of international capital flow into the U.S. is its refusal to agree to the new international disclosure standards that it essentially wrote. After coercing almost 100 countries to sign on to the OECD disclosure standards, the U.S. now refuses to become a signatory.

“How ironic—no, how perverse—that the USA, which has been so sanctimonious in its condemnation of Swiss banks, has become the banking secrecy jurisdiction du jour,” wrote Peter A. Cotorceanu, a lawyer at Anaford AG, a Zurich law firm, in a recent legal journal. “That ‘giant sucking sound’ you hear? It is the sound of money rushing to the USA.”

“By a continuous process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method, they not only confiscate, but they confiscate arbitrarily; and while the process impoverishes many, it actually enriches some….

The process engages all of the hidden forces of economic law on the side of destruction, and does it in a manner that not one man in a million can diagnose.”

Rothschilds & Rockefellers – Trillionaires Of The World

Learn your history before it repeats on you.

By New World Order – 12-3-7

“Money is Power”, or shall we say, “The Monopoly to Create Credit Money and charge interest is Absolute Power”. (Alex James) Amsel (Amschel) Bauer Mayer Rothschild, 1838: “Let me issue and control a Nation’s money and I care not who makes its laws”.

http://www.indybay.org/newsitems/2007/12/02/18464823.php

Rothschild Trillions Quantified

Rothschild’s Control of Central Banks

http://www.bushstole04.com/monetarysystem/rothschild_bank.htm

Rothschilds Financed Hitler Takeover?s

Read More Here: Rothschilds Financed Hitler Takeover?s – henrymakow.com

Bank For International Settlements (BIS): How The Rothschilds Control And Dictate To The World

http://www.bushstole04.com/monetarysystem/bis.htm

The Complete History of the ‘House Of Rothschild’

The Complete History of the Freemasonry and the Creation of the New World Order

Everything about the Rothschild Zionism

How the Rothschilds Became the Secret Rulers of the World

KILL THE MESSENGER: The Deep, Dark, Links Between the Bankers and Political Systems of Our Nation:

http://thetruthnews.info/bankers_and_presidents.html

For the Record, Rothschilds v. Rockefellers

By Judge Anna Von Reitz

Bank for International Settlements (BIS) – The Vatican’s Central Bank

The monster octopus has so many tentacles. But of all these sucking arms, nothing is more secretive than the Central Bank of all central banks, the BIS that is nestled in a country with a Red Cross flag to represent it.

http://geopolitics.co/2015/04/12/bank-for-international-settlements-bis-the-vaticans-central-bank/

Rothschild reveals crucial role his ancestors played in the Balfour Declaration and creation of Israel

The Times of Israel reports that Lord Jacob Rothschild recently revealed new details about the crucial role his ancestors played in obtaining the Balfour Declaration, which “helped pave the way for the creation of Israel.”

The 80-year-old Rothschild is the current head of the banking family and a strong supporter of Israel.

The Balfour Declaration (text below) was an official 1917 letter from the British Foreign Minister, Lord Balfour, addressed to Lord Rothschild, a Zionist leader in Britain at the time and the current Lord Rothschild’s uncle.

During a television interview, the Times of Israel reports that Balfour revealed for the first time the role of his cousin Dorothy de Rothschild.

Rothschild described Dorothy, who was in her teens at the time, as “devoted to Israel,” and said: ‘What she did, which was crucially important.’”

Rothschild said that Dorothy connected Zionist leader Chaim Weizmann to the British establishment. Dorothy “told Weizmann how to integrate, how to insert himself into British establishment life, which he learned very quickly.”

Rothschild said that the way the declaration was procured was extraordinary. “It was the most incredible piece of opportunism.”

“[Weizmann] gets to Balfour,” Rothschild described, “and unbelievably, he persuades Lord Balfour, and Lloyd George, the prime minister, and most of the ministers, that this idea of a national home for Jews should be allowed to take place. I mean it’s so, so unlikely.”

Read more at: https://israelpalestinenews.org/rothschild-reveals-crucial-role-ancestors-played-balfour-declaration-creation-israel/

Central Banks Are Trojan Horses, Looting Their Host Nations

THE MONEY MAFIA: A WORLD IN CRISIS

Swiss De-Pegging Reveals Worthless Western Currencies

When a currency rises in value; this is almost always good for the people of that jurisdiction, but usually bad for the government. Why is this? Simple. As holders of that currency; the people naturally benefit, because as the currency rises in value, so does their purchasing-power – they get more “bang” for every “buck”.

Your Personal Gold Standard

Few understand how to value gold, and even fewer understand that gold is not really an investment — it is money. Of course, if you want a portfolio that preserves wealth, money is a good place to start.

http://sentinelblog.com/2016/03/15/your-personal-gold-standard-2/

Global Bankster Mafia Caught Rigging Markets to Destroy Middle Class

By Christina Sarich

Billion dollar lawsuits are nothing to gold-rigging banks like Deutsche, but the proposition of spending time in jail might just have motivated the notorious criminal institution’s executives to rat on its peers. This is just the beginning of disclosure in the financial industry which the world has never before seen.

Deutsche was fined just over $2.5 billion barely a year ago for rigging interest rates, and now they are admitting in settled U.S. lawsuits this week that they manipulation gold and silver prices on international markets. Part of the settlement involved the naming of co-conspirators in the manipulation of these markets.

The scam is being called ‘the London Gold Fix’, and in addition to Deutsche Bank, Canada’s Bank of Nova Scotia, the U.K.’s Barclays and HSBC, and France’s Société Générale are involved. More than likely hundreds of banks participated in illegally setting prices for gold and silver – but this isn’t really news to those familiar with the ministrations of the elite banking cabal.

Cushy banking jobs are only given to those deemed worthy by the ‘Four Horsemen’ of banking who are among the top ten stock holders of practically every Fortune 500 company and who come from only eight families. According to Global Finance magazine the world’s five biggest banks are all based in Rothschild fiefdoms in the UK and France, though Chinese banks are gaining power.

They are the French BNP ($3 trillion in assets), Royal Bank of Scotland ($2.7 trillion), the UK-based HSBC Holdings ($2.4 trillion), the French Credit Agricole ($2.2 trillion) and the British Barclays ($2.2 trillion).

In the US, a combination of deregulation and merger-mania has left four mega-banks ruling the financial world: Bank of America ($2.2 trillion), JP Morgan Chase ($2 trillion), Citigroup ($1.9 trillion) and Wells Fargo ($1.25 trillion). That’s your four. So, any gold rigging, libor scandal, price fixing, mortgage rate ridiculousness, etc. is going to trickle down from these banking elite.

John Merrill, founder of Merrill Lynch, exited the stock market in 1928, as did insiders at Lehman Brothers, but merger mania left us with just a handful of conspirators that could control entire markets – including the lucrative gold and silver markets.

“If this type of blatant rigging of financial markets is allowed to continue, the world economy will soon face a crisis more devastating to the middle class than anything we’ve seen since the great depression.” – Patrick Dwyer Merrill Lynch

Is it any real surprise, then, that the first class action alleges that the defendants, including The Bank of Nova Scotia, conspired to manipulate prices in the silver market under the guise of the benchmark fixing process, known as the London Silver Fixing, for a fifteen-year period? Or that an identical class action suit was filed for manipulating gold prices? Or that plaintiffs accuse Deutsche Bank of conspiring with Bank of Nova Scotia (BNS.TO), Barclays Plc (BARC.L), HSBC Holdings Plc (HSBA.L) and Societe Generale (SOGN.PA) to manipulate prices of gold, gold futures and options, and gold derivatives through twice-a-day meetings to set the so-called London Gold Fixing. Old news – but of course the corporate, bank owned media is just now setting us all straight.

The lawsuits are just a few of the many in Manhattan federal court in which investors accuse banks of conspiring to rig rates or prices in financial and commodities markets. The banks are ‘too big to fail’ because they rigged it all – oil prices, gold prices, silver prices, interest rates, the US stock market, foreign exchange markets – EVERYTHING. As Matt Taibi has said in a Rolling Stone article, “The illuminati were amateurs.”

As Preston James and Mike Harris explain, “the history of the Khazarians, specifically the Khazarian Mafia (KM), the World’s largest Organized Crime Syndicate that the Khazarian oligarchy morphed into by their deployment of Babylonian Money-Magick, has been nearly completely excised from the history books.” They are talking about this rank and file banking cartel. The full history of this perpetuating fraud can be perused, here.

About the Author

Christina Sarich is a writer, musician, yogi, and humanitarian with an expansive repertoire. Her thousands of articles can be found all over the Internet, and her insights also appear in magazines as diverse as Weston A. Price, Nexus, Atlantis Rising, and the Cuyamungue Institute, among others. She was recently a featured author in the Journal, “Wise Traditions in Food, Farming, and Healing Arts,” and her commentary on healing, ascension, and human potential inform a large body of the alternative news lexicon. She has been invited to appear on numerous radio shows, including Health Conspiracy Radio, Dr. Gregory Smith’s Show, and dozens more. The second edition of her book, Pharma Sutra, will be released soon.

This article (Global Bankster Mafia Caught Rigging Markets to Destroy Middle Class) was originally created and published by Waking Times and is published here under a Creative Commons license with attribution to Christina Sarich and WakingTimes.com. It may be re-posted freely with proper attribution, author bio, and this copyright statement.

Source: http://www.wakingtimes.com/2016/04/22/bankster-mafia-caught-rigging-markets-to-destroy-middle-class/

Dr Paul Craig Roberts

Throughout the Western world the financial system has become an exploiter of the people and a deadweight loss on economies. There are only two possible solutions. One is to break the large banks up into smaller and local entities such as existed prior to the concentration that deregulation fostered. The other is to nationalize them and operate them solely in the interest of the general welfare of the population.

The banks are too powerful currently for either solution to occur. But the greed, fraud, and self-serving behavior of Western financial systems, aided and abeted by governments, could be leading to such a breakdown of economic life that the idea of a private financial system will become as abhorent in the future as Nazism is today.

Dr. Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. Roberts’ latest books are The Failure of Laissez Faire Capitalism and Economic Dissolution of the West, How America Was Lost, and The Neoconservative Threat to World Order.

Full article at: http://www.informationclearinghouse.info/article44385.htm

Mervyn King

Similarly, the former head of the Bank of England (Mervyn King) is predicting catastrophe:

Unless we go back to the underlying causes [of the 2008 crash] we will never understand what happened and will be unable to prevent a repetition and help our economies truly recover. The world economy today seems incapable of restoring the prosperity we took for granted before the crisis. Further turbulence in the world economy, and quite possibly another crisis, are to be expected.

William White

William White, chairman of the Economic and Development Review Committee at the OECD and former chief economist at the Bank for International Settlements (BIS), says the risks posed by global debt levels are greater today than they were in 2007 and that central banking monetary policy has lost its effectiveness. He also explains the crucial differences between modern macroeconomic modeling and complexity theory (or viewing the economy as a complex adaptive system) and the key lessons this has for policymakers, both fiscal and monetary.

LaRouchePAC

Published on Feb 28, 2016

Harley Schlanger from LaRouchePAC joins me for an economic and geopolitical update. Harley warns that negative interest rates is a banking term for theft, and Harley warns “If they start letting the banks steal deposits, what you are looking at is a chain reaction collapse that will wipe everyone out.” But Harley also believes that the Bankster Oligarchs are ripe for a fall, but it will require AMERICAN PATRIOTS to rise up and TAKE them down. We also discuss the 2016 Presidential race which will leave us with the Communist NWO agenda of Hillary Clinton if people allow it. Standing in stark opposition to the Bush-Clinton crime families is Donald Trump. We discuss it.

For REAL News & Information 24/7:

Please notice the amount of credit being used to carry stocks now is significantly larger than it was at previous market tops in 2000 and 2007. Also, the amount of credit has begun to contract, this is a classic margin call being met …so far. The danger of course is as it always has been when margin builds like this. As the equity market pulls back, margin calls are issued and in some cases “forced sales” are done. This can, has in the past and most likely will occur and morph into a virtual loop where forced sales weaken prices, creating new margin calls and more forced sales in a negative feedback loop…otherwise known as a market panic.

It does need to be pointed out, there will be no “white knight” this time around as there are none left.

http://www.jsmineset.com/2016/02/26/contraction-of-credit-central-bankers-greatest-fear/

This brief article will explain why the world’s banking system is unsound and what differentiates a sound from an unsound bank. I suspect not one person in 1,000 actually understands the difference. As a result, the world’s economy is now based upon unsound banks dealing in unsound currencies. Both have degenerated considerably from their origins.

Armstrong Economics: Martin Arthur Armstrong (born November 1, 1949 in New Jersey) is the former chairman of Princeton Economics International Ltd. He is best known for his economic predictions based on the Economic Confidence Model, which he developed.

We live in a world where the difference between assets and liabilities has been blurred. In the old days, an asset was something you “owned” while a liability was something you “owed”. Over the years as everything became securitized, someone else’s liability is now routinely someone’s asset but ONLY thought of as an asset. It has always been this way but in the past what used to be seen as “someone’s liability” is now ONLY seen as “someone’s asset”.

Read more at: https://counterinformation.wordpress.com/2016/03/15/assets-and-liabilities-and-debt-saturation/

How Iceland defeated the Anglo-American Bankster Mafia

JAIL THE BANKSTERS?

Iceland just sentenced their 26th banker to prison for his part in the 2008 economic collapse.

The charges ranged from breach of fiduciary duties to market manipulation to embezzlement: http://www.sott.net/article/310629-26-corrupt-bankers-in-Iceland-sentenced-to-74-years-in-prison

However, we believe that given the chance, everyone would succumb to greed and power. The system itself is what needs to be addressed and urgent measures taken.

Hungary is making history of the first order along with Iceland & Russia

Not since the 1930s in Germany has a major European country dared to escape from the clutches of the Rothschild-controlled international banking cartels. This is stupendous news that should encourage nationalist patriots worldwide to increase the fight for freedom from financial tyranny.

Another Bankster Bites The Dust: Ireland Indicts And Extradites Elite Bankster From United States For Role In The 2008 Derivative Financial Crisis

https://ronmamita.wordpress.com/2016/02/02/in-spain-are-they-going-after-the-bankers/

Ending the Corruption Era

The case of Rodrigo Rato is perhaps the most interesting among some 150 high-level corruption cases scheduled to take place this year in Spain – involving over 2,000 elite figures in Spanish society. Rato was the country’s Minister of Economics from 1996 to 2004, and a leading political force in the conservative Popular Party (PP) as well as managing director of the IMF (2004-2007) and chairman of Bankia, Spain’s largest bank (2010-12).

http://www.occupy.com/article/put-bankers-behind-bars-spanish-citizens-take-1-court

Dope, Inc.

The Crown’s Rage Against LaRouche – Since no later than the 1978 publication of the first edition of Dope, Inc., the British royal family and its entire intelligence and courtier apparatus has been on a rampage against Lyndon LaRouche, the founder and contributing editor of EIR, and the man who commissioned the Dope, Inc. dossier in the first place.

http://rielpolitik.com/2015/10/04/londons-dope-inc-british-drug-empire/

City of London is the global money-laundering centre for the drug trade

More Educational Reads

British Crown Agents Named Bush, Kissinger and Gates

https://tabublog.com/2018/02/02/british-crown-agents-named-bush-kissinger-and-gates/

British/Scottish Ownership of US Cities

https://tabublog.com/2018/02/02/9130/

Guggenheims, Rothschild’s and Criminal Bloodlines

https://tabublog.com/2018/02/02/guggenheims-rothschilds-and-criminal-bloodlines/

Savoy’s and Switzerland; Master Controllers

https://tabublog.com/2018/02/02/savoys-and-switzerland-master-controllers/

The Founding of the USA Corporation. 1871

https://tabublog.com/2018/02/02/the-founding-of-the-usa-corporation-1871/

John Maynard Keynes Economic Consequences of the Peace, 1920

http://politicalvelcraft.org/2016/02/02/stimulate-this-the-perversion-of-keynesianism/

BEFORE THE 2010 GENERAL ASSEMBLY OF THE WORLD FEDERATION OF EXCHANGES

Banking Scam: http://ecclesia.org/forum/uploads/bondservant/BankingScam.pdf

On a point of law, to the best of your knowledge, is there a statute of limitations on fraudulent concealment? I understand that there is not. If that is the case, then we can go back 100 years????

Another question, who owns the government land? The government, being a registered corporation cannot own anything…. Am I right? They have shareholders; which is not the people. Most shareholders are investors; foreign investors.

So, the people can take all the government property back, and kick out the shareholders? B

Hi Bobby,

I am not sure if there is a statute of limitations, but if there is fraud involved then it will be audited from day one; I know that Ashantigold in Ghana were audited going back 200 years;

The RSA is a pty ltd and cannot claim ownership of anything; it is held in trust for “we, the people”; many will argue this point, but here is REPUBLIC OF SOUTH AFRICA, explained in legal terms:

Opublikowano 14 listopada 2011

Common Law Maxims: The inclusion of one is the exclusion of another. The certain designation of one person is an absolute exclusion of all others. 11 Coke, 58b. „expressio unius est exclusio alterius” – A maxim of statutory interpretation meaning the expression of one thing is the exclusion of another.

Blacks Law Dictionary, Sixth Edition So in law when you include something, you are excluding all others… so lets take a look at the definition of the Republic from the income tax act: Republic means the Republic of South Africa and, when used in a geographical sense, includes the territorial sea thereof as well as any area outside the territorial sea which has been or may be designated, under international law and the laws of South Africa, as areas within which South Africa may exercise sovereign rights or jurisdiction with regard to the exploration or exploitation of natural resources; Because this definition of the „republic” includes „the territorial sea” it by maxim, excludes everything else…

So the true sense of the word, the definition is similar to this: The „Republic” means the company „Republic of South Africa” which is limited to the „territorial sea” (wherever that may be) as well as areas outside of this sea (non-specific) which South Africa (note not the „republic”) can exercise sovereign jurisdiction with regards to the „exploration and exploitation of natural resources” (an inclusion which like an exclusion, excludes everything else).

So if you start to put the dots together… you should come to this conclusion…

1. Every ACT in R.S.A is limited to the „Republic”

2. The republic by definition is restricted in its scope and jurisdiction, to the „territorial sea” and nothing else

3. When the „republic” means „south africa” (the land) it is limited to the exploration and exploitation of natural resources…

AND this is where you have to be careful… if you willingly act as a „natural resource” (natural person ??) then you will be exploited. And this is why it is so important to understand the words that are used when you bump up against the corporate officers of the „republic”…

Source: http://www.thinkfreesa.com

Blikskottel…loves to see legal maxims and statutes explained.

I have challenged three banks on my loans credit cards and they failed to deliver, this was done three years back and have since stopped making repayments

I always get letter offers from Nedbank to loan me money up to R200.000. I am tempeted to take the loan. Atleast R50.000 How do i approach this loan without getting into a contract of consenting to repayments & having to write letters to the bank requesting proof of debt?

Dear Simphiwe,

now that we are educated as to the fraudulent nature of banking would we still consider it moral and ethical to further participate in the fraud? Especially, when we know that it is bankrupting our nation and hope of a better future?

Is it not our sacred duty to rather stop feeding the beast?

Should we not be looking for remedy and spending energy on building new models that make the existing ones obsolete?

Not sure where to start? Check our ‘Community Banks’ page for ideas and see what communities all around the world are doing; even Africa:) blessings, bt

Hi once again BT. More than a year ago i sent MFC a cease & decease letter as they were attempting to collect a debt on my car that they repossssed & auctioned. They kept quiet. Today i received this sms.

“Call the NRR Sheriff Liaison Officer managing your account and the scheduling the time and the date of the visit to your home and work regarding your Legal MFC B Account. Phone 031 8202555 or 031 8202556 Ref: VMFB10869. Your Visit Reference No: SLOHOMEADDRESS & SLOWORKADDRESS”

How do i deal with this issue now, what do i d if they arrive on my doorstep for a visit, do i respond to this sms?

Hi S, it does not sound as if they have a court order; unless they do, along with a certified copy of the claim and a letter of authority then they are a third party interloper; take them to the local police station; the warrant officer knows the rules; sheriffs have rules; read the sheriffs rules; educate and inform yourself;

And, remember at the end of the day, its only a car; and, right now, the world is dying because of cars; we gave up car, home, business and even our name to be free and to do this; what bliss; we all leave this matrix with nothing, dear friend; not even dust;

Right now our hands are full with taking the beast head on; for everyone; as well as you; good luck; in peace

blessings bt

By the way i think i must clarify this matter. This matter is not about a car, my car was repossessed about 18 months ago. The debt is for a shortfall created when they auctioned my car. Over R150.000. I am going to loose all my household goods in the house when they come.

I did send a cease & deseast letter to the bank more than a year ago but obviously they ignore my letters as usuall.

Is there a court order? Find out and email us; in peace

I phone them. They say they cant give me a court order or it sounded like they dont have one. They said they can only give me certificate detailing amount being owed.

Told them that the certificate i dont need. I gave them your email address to send papers to.

Call was recoded.

Simphiwe, they are trying to get your consent; once you have entered into any agreement they will take your private property;

Reject all offers; until they have a court order they are acting outside their own rules and you reserve the right to take action;

Kindly take notice that we will not be responding to the sheriff’s email; our hands are full with the international action;

Respectfully, in peace; bt

How do i stop these lawyers now from sending me these daily treath messages?

“URGENT Message from Groenewald Att: Final Chance. If we do not hear from you TODAY, REGARDING YOUR Nedbank Legal MFC B Account, the Sheriff may serve a WRIT at your home to attach your Movable Assets soon. Call 0861127327 Ref VMFB10869

Simphiwe, we told you many times before; they are fishing; tell them there offer is rejected; they must have a court order; letter of authority and certified copy of the contract in question; if not they are third party interlopers; they are using psy warfare on you; stand up for your rights; the obedient will be slaves; in peace

Thanks.

1 Tim 6v 10: For the love of money is the root of all evil: which while some coveted after, they have erred from the faith, and pierced themselves through with many sorrows.

These words are true indeed. ps: The Rothchilds has also been responsible for building an illuminati temple in Jerusalem !! …surprisingly to most people: The Supreme Court Building

See web site for more info :

http://molonlabe70.blogspot.com/2008/02/rothschild-israeli-supreme-court.html?m=1